After coming across so many stories of people overspending their money and are unable to pay for sudden health bills when bad news strikes, I feel really perplexed why Singaporeans don’t plan adequately for rainy days. There are health insurances out in the market that Singaporeans can purchase with their CPF Medisave Account to cover part of their healthcare cost should they be inflicted with sickness and injuries.

With a relatively affordable cash rider, Singaporeans can opt for ‘As Charged’ Plans where they can redeem the full cost of their medical bill! Thankfully with the new Medishield Life, we are finally inching towards ‘free’ healthcare for all Singaporeans, but many are still clueless about what Medishield Life will mean for them.

Here are 5 things you should know about Medishield Life (if the MediShield Life Review Committee recommendations are accepted by our government).

1. Higher Claim Limits & Inclusion Of Pre-Existing Illnesses

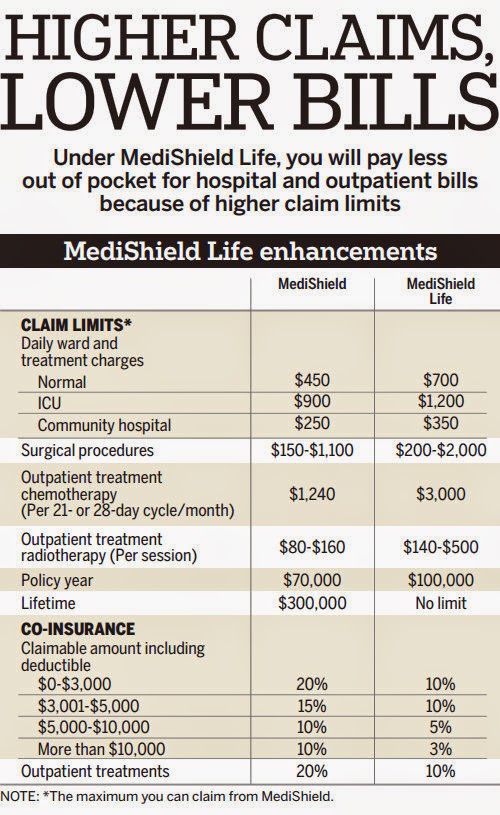

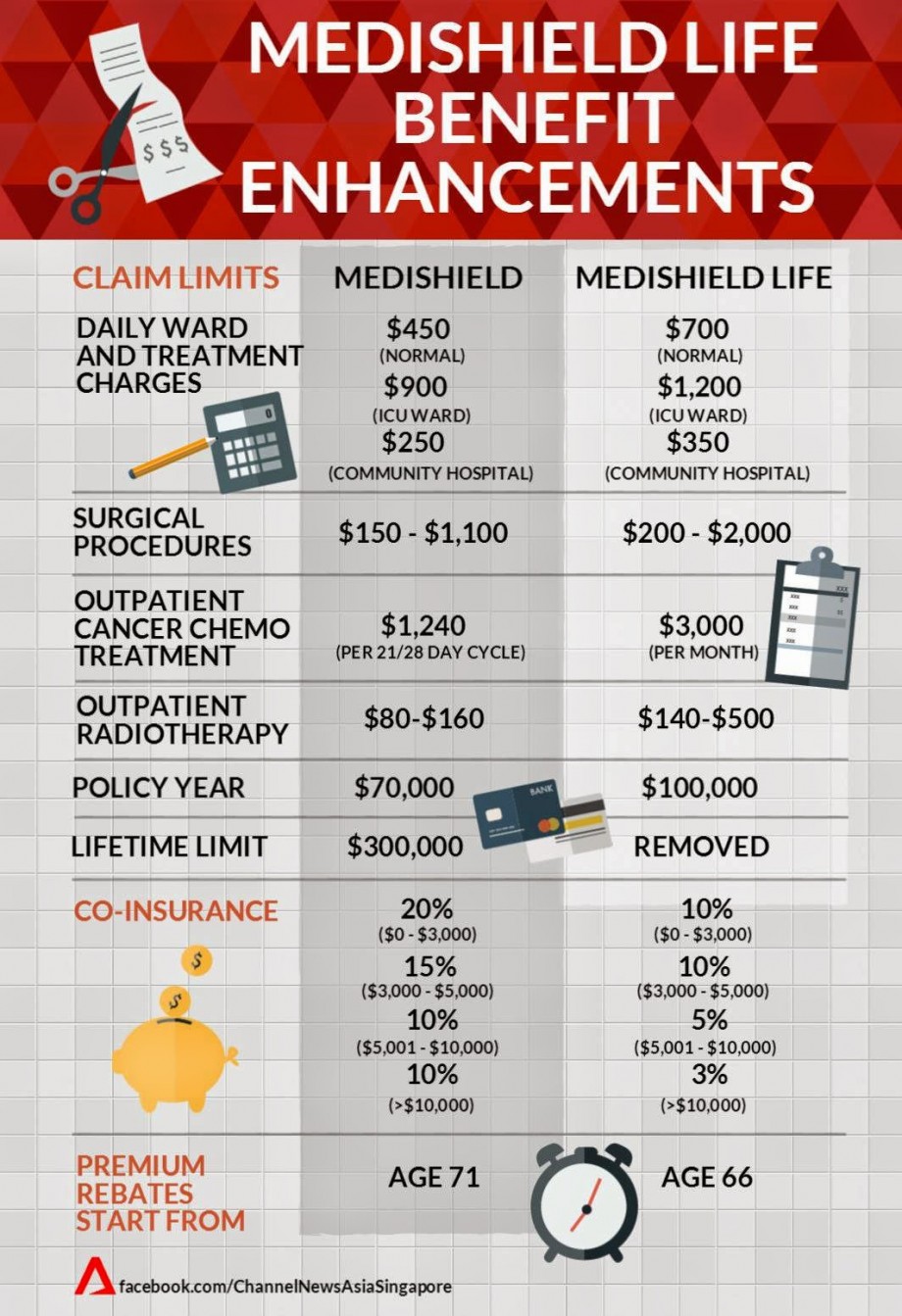

The claim limits for MediShield Life will be higher for a host of services. The lifetime claim limit will be removed and the yearly claim limit will increase to $100,000 from the current $70,000.

The daily claim limits for normal, ICU and community hospital wards will increase as shown below:

More importantly, Singaporeans with pre-existing illness who used to be shunned by insurers will now enjoy protection under the new plan. (Our current Medishield Plan stops coverage at 90 years old and does not take in people with existing conditions.)

2. Lower Co-insurance Payments

The new scheme strives to reduce co-insurance, that is the percentage of the bill you need to pay on the portion of the bill above the deductible, from the current range of 10-20% to 3-10%.

I personally hope to see this part drop to 0% and hope the committee can recommend in future to let Singaporeans opt for ‘As Charged’ coverage using their Medisave Account rather than a cash top up.

There are Singaporeans who can well afford the option of upgrading our Medisave Life with a rider to make it ‘As Charged’ using our CPF Medisave funds.

Why must this top up still be a cash component when there are sufficient sum in our Medisave Account to pay for it?

2. More subsidies for treatment, surgery

There will be more subsidies for high cost surgical procedures and outpatient chemotherapy and radiotherapy treatments.

This means greater protection at where it matters most for terminally ill patients.

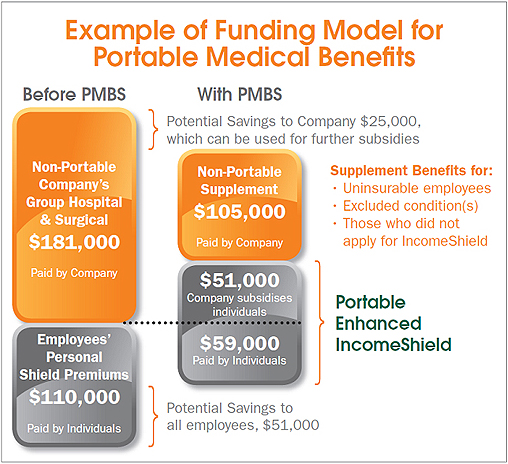

4. Every Worker Can Have His/Her Own Portable Medical Benefits Scheme

With Medishield Life covering all Singaporeans, it is beneficial for employers to consider shifting their group employee insurance to a Portable Medical Benefits Scheme (PMBS).

Currently, many companies and employees both pay premiums for separate health insurance plans, creating a duplication of health cover which sees wastage of both company and employee money.

If companies were to pass a portion of their group insurance plan to their employees to pay for health insurance, employees have the option to upgrade to Integrated Shield Plans that allow them to stay in higher class wards.

In addition, workers will still get to enjoy insurance coverage if they quit.

5. Premiums Will Go Up

Yes, all the above increased benefits are not without its cost. Premiums will be going up. The exact increase will be finalised by July but the committee mentioned that the increases for most policyholders should be no more than 3% from current premiums.

Singaporeans with existing illnesses will pay a higher premium “reflective of their higher risks”, at 30% more than they currently pay, for a period of 10 years. To help Singaporeans manage the increase premium cost, the committee has proposed the following measures:

1. Additional Employer Medisave Contribution Will Cover Premium Increase

Worried about premium increases? Union chief Lim Swee Say mentioned that workers will find it “reassuring” that the additional 1% employer Medisave contribution that employers are expected to fork out from next year (announced in Budget 2014) will be enough to cover increases in premiums.

2. Premium Rebates Start Earlier

We all know that the older you are, the more expensive your coverage. To aid our older folks with premium payments, our government will also give out premium rebates earlier at 66 years old, instead of the current 71 years old.

Premium rebates can go up to $449, depending on what age a person joins the scheme and what age group he or she is currently in.

3. Premium Subsidies & Permanent Aid

Our government will be giving out transitional subsidies to all Singaporeans over four years. The amounts have not yet been revealed.

There will also be premium subsidies, financial assistance and other forms of funding support for lower to middle income families. The Ministry of Health will finalise the amount of these subsidies at a later date.

4. More help for Pioneer Generation

Our typical Pioneer Generation retiree household will enjoy a decrease in their total payable premiums.

Inching Towards ‘Free’ Healthcare In Singapore

To Singaporeans who are against the compulsory upgrades of CPF Medisave Life, you better pray that I never witness you crying one day on National Television Charity Program to ask members of the public to donate money for your medical bills. Other than medical and healthcare needs, you will not be able to use your CPF Medisave for property or investments, why not utilise the money to ensure adequate protection for rainy days?

If NTUC Deputy Chief Heng Chee How gets his way, older workers will be given more help to build up their CPF savings, e.g. having the option to be re-employed till 67 years old, reviewing the CPF contribution ceiling and government CPF top ups to ensure every citizen’s retirement adequacy is sufficient.

MediShield Life is a godsend for Singaporeans who are uninsured, uninsurable or likely to live a long life. I am glad that our government is slowly making the progress to ensure ‘free’ healthcare service in Singapore where all Singaporeans are protected from heavy medical cost through a comprehensive health insurance and ability to pay for this insurance via Medisave.

We have yet to reach the stage of full 100% protection but we are definitely inching slowly towards there.

I can’t wait for that day to arrive!