Mention the raising CPF Minimum Sum and increasing draw down age to most Singaporeans and you are likely to hear angry retorts such as ‘It is my money, I can manage it on my own’ or laments such as ‘When can I ever enjoy the fruits of my labour?’. As much as I appreciate our government well intended scheme put in place to make sure that Singaporeans have a stable stream of monthly income after retirement, I personally feel that there are some small tweaks that can be put in place to make the scheme more palatable for our people.

What Is The CPF Minimum Sum About?

The CPF Minimum Sum Scheme aims to provide Singaporeans with a monthly income to support a basic standard of living during their retirement. Singaporeans can receive monthly payouts from their Retirement Account when they reach Draw Down Age which has now been extended to start from 65 years old. The monthly payouts are designed to last for about 20 years, or until the member’s Retirement Account savings are exhausted. The monies in the Retirement Account currently earns 4% interest per annum and interest rate is reviewed yearly.

Upon reaching 55 years old, Singaporeans are able to withdraw the portion of their CPF savings in excess of the Minimum Sum. At the age of 65 years old, Singaporeans can go for CPF LIFE or buy approved life annuities with their Minimum Sum to give them a guaranteed income for life.

Common Grievances

To cater to Singaporeans’ rising expectations of what is considered a basic standard of living in retirement, the CPF Minimum Sum has been increasing for each group of members turning 55 yearly, to reach a target of $120,000 (in 2003 dollars) by 2015. In order to maintain its real value over time, the Minimum Sum increases to account for inflation.

But the concept of Minimum Sum was not readily acceptable by all Singaporeans, here are some of the more common grievances heard from the ground:

1. We Can Manage Our Own Finances

Many Singaporeans especially the younger and more educated ones believe strongly that they have the ability to manage their own finances at old age.

They hope that the government can loosen its apron strings, abolish the minimum sum and allow them the freedom to wield their own money the way they want it.

2. We Will Never Be Able To Reach The Minimum Sum

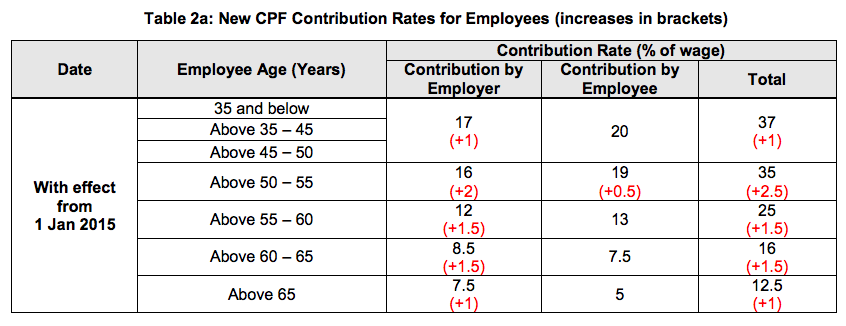

Although the government has agreed to raise the CPF contribution rates in 2015 after NTUC called to increase the employer CPF contribution rates, older workers still have lower contribution rates after they turn 50 years onwards, which makes it harder for them to hit the Minimum Sum.

3. We Need Money Now

There are less fortunate Singaporeans who are living from hands to mouth everyday. If they are unable to cope with their livelihood today, how do they survive to see the monthly distribution of their monies down the next 20 years?

4. We Need The Money For Medical Treatment

You can offend hear the old folks commenting that medical fees are so ridiculously high in Singapore that they are better off dead if they are ever sick. This is true given that our CPF Medical Account does not completely cover Singaporeans for all kinds of medical treatments and we are also unable to claim the full medical fees.

If someone is unable to seek medical treatment due to lack of funds today and does not survive till retirement age, what good is a retirement fund that pays them for life?

5. We Want To Pursue Our Dreams / Enjoy My Remaining Years

Some Singaporeans long to fulfil their dreams after their retirement and they need the money to do so. What is life without the ability to live their retirement life the way they want it.

Other Singaporeans also questioned if it is appropriate to hold onto an old folk’s minimum sum when they have been diagnosed with terminal illnesses. Their days are numbered and they should be given the money to do what they desire.

Other than the above 5 grievances, there are of course other non-grounded comments but we shall not go there.

Bridging The Acceptance Gap

1. Give An Option To Opt Out

We understand our government concerns that some Singaporean may not be financially-equipped to manage their retirement funds well. But we might just be looking at a small group of Singaporeans who will run into debt issues.

If our government is willing to mitigate the possible social risks with the introduction of 2 casinos in Singapore, I have faith that our government will be able to manage potential social issues that may arise from giving financially-savvy Singaporeans the option to opt out of Minimum Sum on certain conditions other than proof that they have bought their own life annuity using cash which pays a monthly payout equal or above the Minimum Sum monthly payment.

2. Disburse & Monitor

What if the government can provide various options to disburse the Minimum Sum?

For example, NTUC deputy chief Heng Chee How suggested the government can consider increasing the payout rates from the CPF LIFE annuity scheme.

Can the CPF Board have an option to disburse a third of the Minimum Sum at the age of 62 years old and monitor each individual’s retirement adequacy over a period of e.g. 5 years?

If the individual does not declare bankruptcy or seek social help over this period and financially he is prepared for retirement, perhaps he or she can then opt to withdraw the remaining two-thirds in two separate instalments in the future.

3. Draw Down Age Should Be Retirement Age For Unemployed?

Singaporeans official Retirement Age is 62 years old but the current Draw Down Age is 65 years old. This effectively means that our old folks need to survive 3 years on their own without monthly income from work.

This does not make sense. If Minimum Sum is meant to supply retired Singaporeans with monthly income, the draw down age should commence from our official Retirement Age unless opted otherwise.

4. Be Consistent

CPF Board should be more consistent with looking after the welfare of Singaporeans. They are concerned with setting up Minimum Sum to help Singaporeans cope with income after retirement but inadequate efforts are placed to help Singaporeans cope with high medical fees.

Can the government allow Singaporeans to use our CPF Medisave to pay for the health insurance rider which covers deductible and co-insurance? This will ensure that Singaporeans are protected from all medical fees incurred while hospitalized as these fees will be borne by their respective insurer.

This will take away pressure from Singaporeans who need access to Minimum Sum for cash to pay off portions of hefty medical bills that their current health insurance doesn’t cover.

5. Allow Exemptions

Exemptions should be given for Singaporeans who are terminally ill to be able to withdraw their Minimum Sum to pay for their medical fees or use the money to fulfil their final wishes.

A council could perhaps be set up to address exemptions requests.

Your Turn To Ponder

What are your personal thoughts when it comes to Minimum Sum? Are you for it or against it?

Please share with us your views and give us more suggestions on how can our CPF Board can better bridge acceptance for its Minimum Sum Scheme.